Table of Contents

Financial accounting is important for students because it gives students a firm grasp of how businesses record, collect, and report financial transactions. It prepares students for jobs in management, auditing, and finance. However, many students struggle with financial accounting assignments as they involve complex calculations, unfamiliar formats, and the need for precision in every entry. This is where they look for financial accounting assignment help to get the right support they need to complete the assignments accurately and confidently.

However, there are also some easy ways to do a financial accounting assignment on your own. This blog of All Assignment Help will guide you towards understanding the specifics of financial accounting and how you can write a perfect assignment on your own.

What Is Financial Accounting?

Financial accounting is the methodical process of documenting, analyzing, and presenting a company’s financial transactions. It involves preparing financial statements that accurately represent the condition of the financial health of a company over a given time.

Financial accounting guarantees the reliability and comparable nature of the data reported across various reporting periods and firms by following predefined standards and principles.

However, it is tough to understand financial accounting in one go as it involves mathematical concepts. But you do not need to worry, as you can get financial accounting assignment help from online experts. These are the best in every parameter. They can help you with your assignments, classes, and other writing tasks as well.

Read Here: Financial Accounting: Definition, Objectives, Qualities, and Financial Statement

Key Concepts of Financial Accounting

Before writing any financial accounting assignment, you must make yourself familiar with its key concepts. These concepts form the cornerstone of assignment writing. Here are the key concepts that you must know:

Double-Entry Accounting

The concept of the double-entry accounting system greatly dominates accounting in finance. It says that in any transaction, the effects are equal and opposite, but for the two different accounts. Consider the example in which the company sold products containing both the generated revenue from the sale and the corresponding decreases in inventory. This is the way to keep the accounting formula (Assets = Liabilities + Equity) equilibrated throughout all times.

Accrual Basis vs. Cash Basis Accounting

The finance accountants may use either accrual basis accounting or simply cash basis accounting to record the revenues as well as expenses. The accumulation principle is the other method of recording the transactions, which is made when the transactions are incurred or earned no matter of when cash is transacted. On one hand, accrual accounting provides a true financial picture of how a company operates over time, and on the other hand, cash accounting is easier and quicker to utilize.

Assets, Liabilities, and Equity

The balance sheet brings a financial image of a company whereby the composition of its resources is articulated in three main blocks, namely: assets, liabilities, and equity. The accounting equation would simply be represented by the balance between assets on one hand, and liabilities and equity on the other. The grasp of working in the area among these factors is the key to the valuation, liquidity, and finality of the financial reliability.

Financial Ratios

Financial ratios serve as a powerful analysis tool for the different dynamics of a company. Considering ratios such as return on investment (ROI) and net profit margin, which evaluate financial performance, it is possible to profile the ability of the company to yield maximum profits. While ratios like the current ratio reflect its capability to meet its short-term obligations could throw light on its liquidity position.

These are the fundamental but challenging concepts of financial accounting. Therefore, we suggest enrolling in online accounting and financial classes. Here, you will receive instruction from professionals in the field who will teach you the fundamentals of the subject. Also, a lot of students nowadays prefer to get help from a professional subject matter expert whom they can ask, can you take my online accounting class for me? You can also give it a try on them to get additional assistance with your online classes and coursework.

What Does a Financial Accounting Assignment Include?

As a student pursuing accounting or finance, you might often come across financial accounting assignments. This set of assignments is intended to improve your understanding of accounting concepts, procedures, and real-world applications. However, writing assignments is not easy. You might need help with financial accounting assignment to do the task.

But what exactly does a financial accounting assignment include? Let’s find out:

Journal Entries and Ledgers

Journal entry recording is one of the core elements of every financial accounting assignment. Students are asked to use the double-entry approach to enter transactions in the appropriate journal format. After this, they are posted into their respective ledger accounts. In this part, knowing how to balance credit and debit inputs is important.

Trial Balance Preparation

Often, you may need to create a trial balance after journaling and posting. This makes it easier to make sure that the accounting equation is balanced and that all entries are accurately recorded. Any discrepancy in the trial balance might be a sign of mistakes that should be fixed before continuing.

Financial Statements

Students are usually asked to prepare the income statement, balance sheet, and cash flow statement as part of their assignments. These reports provide an overview of a company’s financial status and performance over a specified time frame. Hence, you need to understand the proper structure and interpretation of these statements.

Theoretical Questions

Besides numerical problems, financial accounting assignments often include theoretical questions. These could be related to accounting standards (such as GAAP or IFRS), principles (like the accrual or matching principle), or ethical issues in accounting. You can get financial accounting assignment help if you face problems while solving theoretical questions for your assignment.

Case Studies and Scenarios

You could also be given a business case or a real-life situation in some assignments. You are expected to analyze the financial data, identify issues, and propose accounting solutions or decisions based on your knowledge.

A financial accounting assignment combines conceptual knowledge with practical experience. It assesses how well you can accurately record, analyze, and report financial data. If you ever find it challenging, you can get financial accounting assignment help from academic experts who will help you improve your grasp of the subject and boost your academic performance.

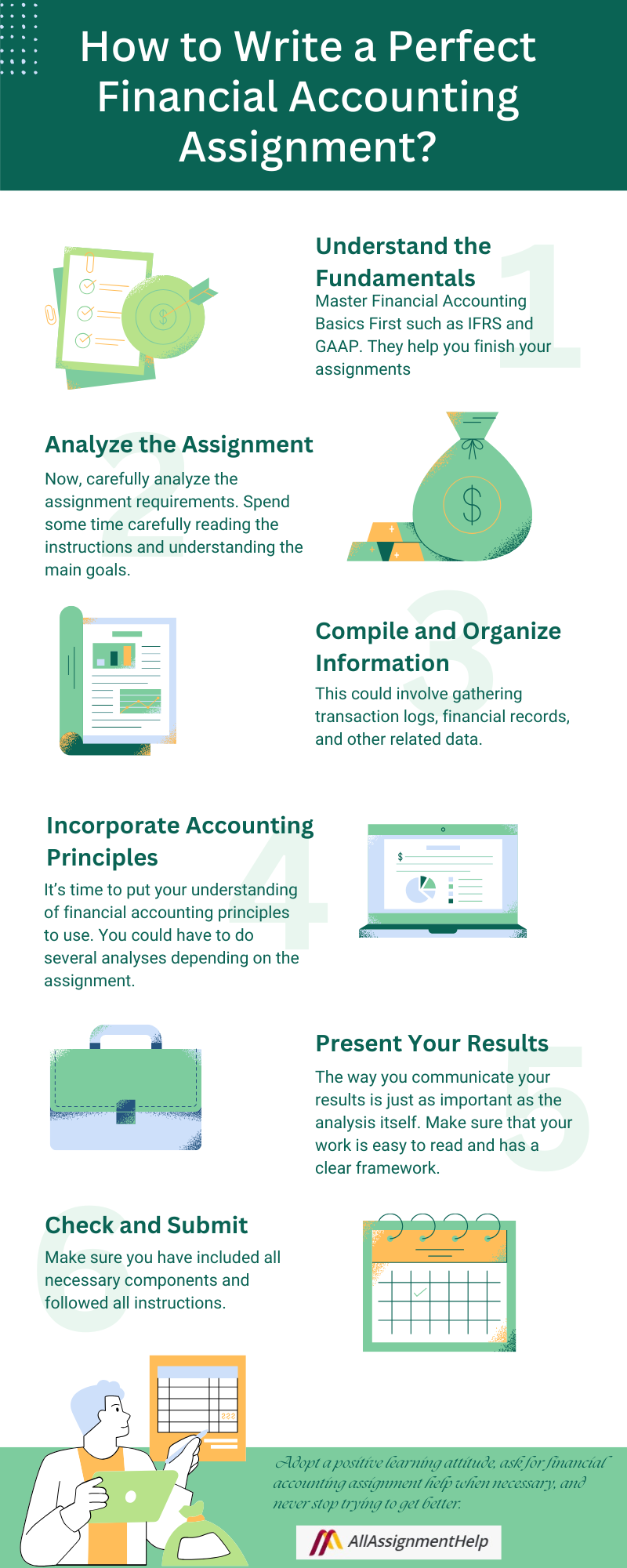

How to Write a Perfect Financial Accounting Assignment?

Even though financial accounting assignments might seem stressful, you can succeed in them by approaching them systematically. Below is your step-by-step financial accounting assignment guide to help you write a perfect and accurate assignment:

Understand the Fundamentals

It’s necessary to have a firm grasp of the fundamental concepts of financial accounting before starting your assignment. Your research will have a solid basis if you understand the fundamentals, such as International Financial Reporting Standards (IFRS) or Generally Accepted Accounting Principles (GAAP).

Having a firm understanding of these concepts will help you finish your assignments and get ready for practical financial applications. However, if there are particular concepts that you find challenging, think about talking with your teacher or using online resources such as financial accounting assignment help.

Analyze the Assignment

The next stage is to carefully analyze the assignment requirements. Spend some time carefully reading the instructions and understanding the main goals. The following are some questions to ask yourself:

- Which particular requirements apply to this assignment?

- Do I have to pay close attention to any specific financial statements or data sets?

- What is the required format for submission?

- Understanding these aspects will enable you to approach the assignment with clarity.

Compile and Organize Information

Now that you have an accurate understanding of the assignment, it’s time to collect the required information. This could involve gathering transaction logs, financial records, and other related data. This checklist will assist you in maintaining organization:

- Identify the Documents Needed: Choose the financial statements (cash flow, balance sheet, and income statement) important for your analysis.

- Gather Information: Collect information from trustworthy sources, including academic journals, textbooks, or trustworthy financial websites.

- Arrange Your Findings: Make a clear structure to classify the information you have. You can refer to it more easily while you complete the assignment.

Incorporate Accounting Principles

After gathering information, it’s time to put your understanding of financial accounting principles to use. You could have to do several analyses depending on the assignment, including:

- Ratio Analysis: Consider important ratios such as leverage, profitability, and liquidity ratios to assess the financial health of a company.

- Trend Analysis: Assess financial data over time to find trends and patterns that can help you conclude.

- Cost-Volume-Profit Analysis: Analyse the effects of volume and cost changes on a company’s operational and net profits.

If you find these principles hard to understand, you could go for online assignment help from experts. They will help you understand each of them and how to apply them in your assignment.

Present Your Results

The way you communicate your results is just as important as the analysis itself. Make sure that your work is easy to read and has a clear framework. Keep the following tips in mind:

- Divide your work into parts with distinct headings to help the reader follow along.

- Use bullet points to highlight significant information or summarize important results.

- Follow any special formatting rules that could be included in the assignment specifications. This covers citation styles, font size, and margins.

Check and Submit Your Assignment

Once your assignment is finished, spend some time going over your work in detail. Verify your analysis for inconsistencies and math mistakes, and make sure your findings are supported by solid evidence. Also, check your work for grammar and spelling mistakes.

Before submitting, make sure you have included all necessary components and followed all instructions. Additionally, you can ask your teacher for assistance if you have problems concerning the submission procedure.

Dealing with complex problems and nuances in financial accounting necessitates expert guidance. Never be afraid to ask for financial accounting assignment help from professional accountants, financial advisors, or auditors if you run across difficult accounting problems or unclear regulatory queries. These experts are also available to provide you with online class help if you have enrolled in an online financial accounting program. They are experts in this area, so they won’t have any trouble understanding financial terms and can assist in managing a challenging financial world.

Also Read: Upgrade Your Skills with Technology in Accounting Education

Conclusion

By following these easy ways to do financial accounting assignments, you will be prepared to take on your financial accounting assignments confidently. Remember, it takes time and effort to become proficient in financial accounting. Adopt a positive learning attitude, ask for financial accounting assignment help when necessary, and never stop trying to get better. Also, if you are unable to write your assignment on your own, you can hire our subject experts and share your requirements with them. They will do your assignment timely and perfectly.

FAQs

What are the common challenges students face while writing financial accounting assignments?

Students often struggle with complex calculations, understanding accounting standards, journal entries, and time management while writing their financial accounting assignments.

How to stay organized while working on a financial accounting assignment?

To maintain an organized workflow, divide the assignment into smaller tasks, create a checklist, and allocate specific times for each portion.

What are some quick tips to avoid mistakes in financial accounting assignments?

Always compare your final results with balance sheets or ledgers, double-check the data you provided, and understand the principles before implementing them.

Can online assignment help services be trusted for financial accounting assignments?

Yes, if you choose reputable and verified platforms with experienced subject experts and genuine reviews.